En tant qu’automobiliste, vous savez mieux que personne à quel point votre voiture vous est indispensable tous les jours, que ce soit pour aller travailler, pour emmener vos enfants à l’école ou, plus légèrement, pour vous promener. Mais une voiture est avant tout un équipement technique qui a besoin d’être rigoureusement entretenu pour rester en parfait état de marche. Et si vous n’êtes pas tout à fait à l’aise avec la mécanique auto, de réelles difficultés pourraient s’imposer à vous. C’est précisément pourquoi nous avons tenu à développer ce blog entièrement dédié à l’univers automobile. Grâce à tous nos conseils d’experts, il vous sera enfin possible de profiter pleinement de votre voiture, quelles que soient vos compétences en mécanique auto.

Des comparatifs détaillés pour bien équiper votre voiture

Il est vrai que certains accessoires ou équipements automobiles peuvent être relativement techniques comme l’explique très bien ce site auto, comme les valises de diagnostic auto ou les alternateurs de voiture par exemple. C’est pourquoi, quel que soit le sujet que nous avons abordé, nous avons fait en sorte de rester très simples et conçus afin que vous ne vous perdiez pas dans tout un tas de données techniques incompréhensibles. En clair, en faisant le choix de consulter nos différents comparatifs, vous aurez la garantie que votre prochain achat vous apportera toute la satisfaction dont vous rêvez.

Tout ce qu’il faut savoir sur l’actualité automobile !

Pour profiter pleinement de sa bagnole, il est aussi souvent nécessaire de se tenir au courant de l’actualité automobile, qu’il s’agisse ou non d’un centre d’intérêt pour vous. En effet, du fait que les lois concernant le code de la route changent sans cesse ou que des nouvelles innovations viennent régulièrement révolutionner notre façon de conduire, rester informer de ce qui se passe dans le monde automobile est quelque chose de primordial.

Beaucoup de site comme https://pour-ma-voiture.com/ abordent ces différents sujets. Mais sur ce blog, nous avons souhaité aller encore plus loin en vous proposant de découvrir lors de chacune de vos nouvelles visites tous les changements à prendre en compte en ce qui concerne le code de la route, et plus largement, l’univers automobile de charles. Ainsi, en prenant le réflexe de nous rendre visite régulièrement, vous ne passerez à côté d’aucune actualité et pourrez ainsi prendre la route dans les meilleures conditions.

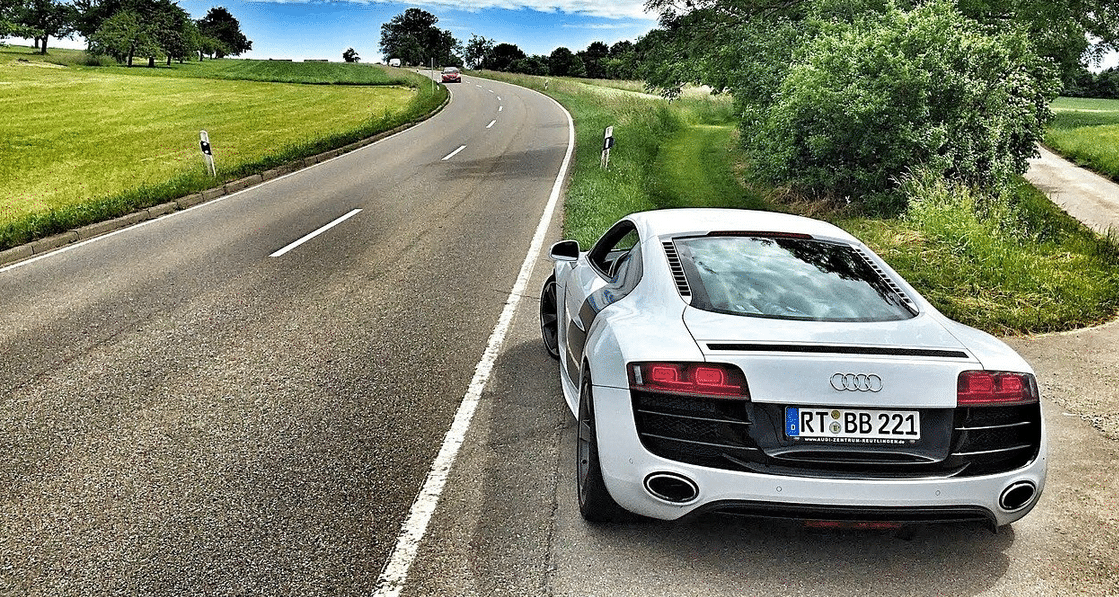

Quels sont les documents nécessaires pour une location voiture prestige Nantes ?

Souhaitez-vous vivre une expérience de conduite inoubliable, que ce soit pour votre propre plaisir ou pour faire forte impression auprès de clients lors d’une consultation professionnelle ? La location d’une voiture de prestige à Nantes est une option hautement recommandable pour répondre à ces besoins. En optant pour cette alternative, vous aurez l’occasion de profiter […]

voyant moteur qui s’allume sur Mercedes Classe A

Vous êtes au volant de votre Mercedes Classe A lorsque soudain, le voyant moteur s’allume. Panique à bord? Pas question! Notre guide pratique vous révèle les étapes clés pour identifier et résoudre ce mystère automobile avec assurance. Découvrez comment transformer cette lumière intimidante en une simple péripétie. Restez branché, car nous allons plonger dans le […]

Conduire en hiver : comment faire face aux conditions difficiles sur la route?

L’hiver est une saison éprouvante pour de nombreux conducteurs, notamment en raison des routes glissantes et enneigées. Pour être sûr de rouler en toute sécurité, il est essentiel de suivre quelques conseils pratiques relatifs à l’entretien du véhicule, à la conduite et au choix de l’équipement idéal. Dans cet article, découvrez les stratégies, les astuces […]

Entretien des tissus de voiture avec des produits respectueux de l’environnement

La voiture est bien plus qu’un moyen de transport ; elle reflète le style de vie et les préférences personnelles de son propriétaire. Pourtant, l’entretien de l’intérieur de notre véhicule est souvent négligé, malgré son importance capitale. L’habitacle, et plus spécifiquement les tissus, sont sujets à de multiples agressions quotidiennes : taches, poussière, déversements et […]

Quel est l’essentiel des infos à avoir sur l’assurance bris de glace ?

La protection des usagers de la route est assurée par de nombreux dispositifs. Ceux-ci impliquent non seulement les automobiles, mais aussi leurs usagers. L’assurance bris de glace est l’une des formes les plus connues par les usagers. Dans ce billet, vous découvrirez les informations utiles à avoir sur cette forme d’assurance. De quoi est-il question ? […]

Pourquoi utiliser un pare-soleil de voiture chaussette?

Si vous envisagez d’utiliser un pare-soleil de voiture chaussette pour vos fenêtres, il y a plusieurs raisons pour lesquelles vous voudrez peut-être l’envisager. Que vous ayez besoin de protéger vos yeux de l’éblouissement du soleil ou que vous souhaitiez simplement ajouter un accent élégant à votre voiture, les pare-soleil peuvent être utiles. Contrairement aux pare-soleil […]

Pourquoi la R5 est-elle si emblématique ? Où trouver les pièces pour l’entretenir ?

Nous comptons aujourd’hui des milliers de voitures de luxe en phase avec les dernières innovations technologiques. Cependant, si nous devons remonter le temps, nous remarquons que certains modèles de véhicules, certes anciens aujourd’hui, ont fait les beaux jours de plusieurs constructeurs automobiles. C’est le cas du constructeur français Renault, dont on se rappelle encore le […]

Comment fonctionne la récupération de points de permis ?

Un permis de conduire valide doit remplir des conditions et détenir un certain nombre de points. Il arrive cependant que les points du permis soient retirés au propriétaire suite à des infractions (excès de vitesse, conduite sous l’emprise d’alcool, conduite inappropriée…). Le nombre de points retirés est proportionnel à la gravité du délit commis. Toutefois, […]

Comment trouver de bonnes pièces de rechange pour les moteurs de camion ?

Bien qu’il paraisse robuste, un camion n’est pas toujours épargné par les pannes. La vétusté ou la défectuosité de certaines pièces et en l’occurrence celles du moteur sont des sources de dysfonctionnement. Pour alors redonner un coup de jeune au moteur de son camion, le recours à de nouvelles pièces s’avère nécessaire. Toutefois, l’exercice n’est […]

Nos conseils pour réussir votre examen au Code de la route

Selon le ministère de l’Intérieur français, près de la moitié des candidats au Code de la route échouent lors de leur première tentative. Certes, le niveau de difficulté des examens est élevé, mais il est possible de réussir l’ETG dès le premier coup. Vous envisagez de passer le permis de conduire prochainement ? Vous vous demandez […]

Comment s’y prendre quand le voyant triangle orange s’allume sur Opel Zafira ?

Il est important de comprendre la définition du témoin lumineux triangle orange de votre Opel Zafira. Lorsque vous conduisez votre Opel Zafira, vous pouvez reconnaître plusieurs témoins lumineux qui apparaissent sur le tableau de bord de votre véhicule. Vous ne devez pas ignorer ce message pour assurer le bon fonctionnement de votre véhicule. Il est […]

La préparation esthétique automobile : quel intérêt ?

La préparation esthétique automobile est une branche du secteur qui a vu le jour pour répondre à de nouveaux besoins. Ce métier du secteur de l’automobile conserve la beauté intérieure et extérieure des véhicules. Il est grandement favorable aux personnes qui y ont recours. La préparation esthétique automobile se sert de nombreuses techniques. Accessibles à […]

Quel déshumidificateur de voiture choisir ?

En raison de la pluie, de la neige et de la buée, le taux d’humidité peut être assez élevé dans une voiture. Si rien n’est fait, cela peut endommager des pièces et mettre le passager dans l’inconfort. Pour le réguler, les déshumidificateurs de voitures constituent une excellente solution. Ci-dessous les deux meilleurs modèles actuellement vendus. […]

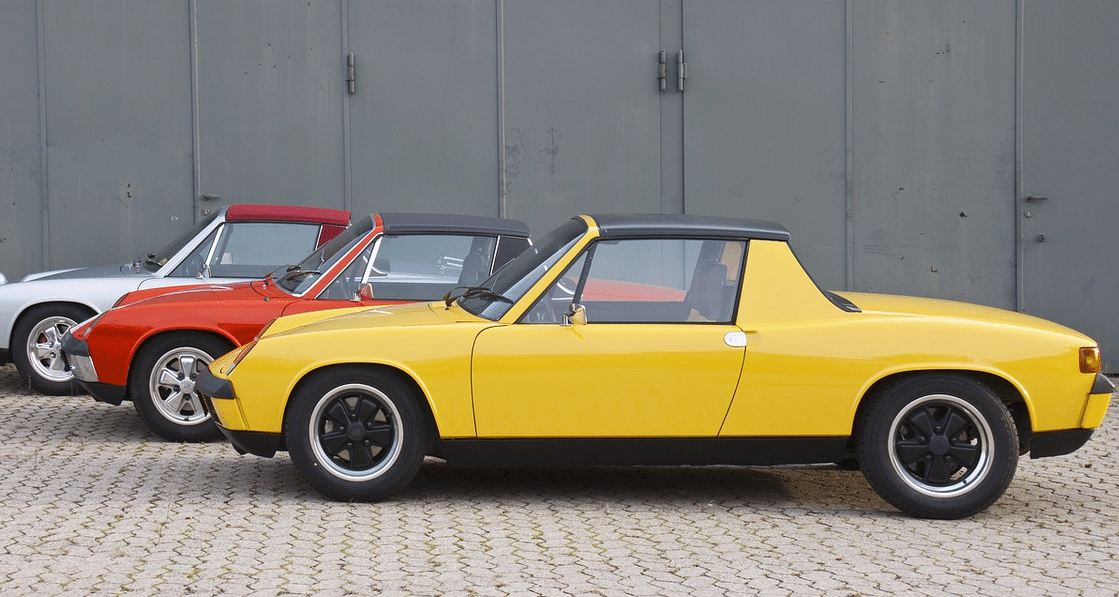

À la découverte de la Porsche 914

La Porsche 914 est un roadster des années 1970 qui est aujourd’hui très prisé par les collectionneurs de voitures. Avec une architecture semblable à celle d’une voiture de course, la Porsche 914 se démarque des autres modèles de la marque en raison de ses particularités et de ses performances. Spécialement conçue par Volkswagen et Porsche, […]

Où aller faire sa carte grise ?

Que vous achetiez une voiture neuve ou d’occasion, dans tous les cas, certaines démarches administratives devront impérativement être réalisées dans les meilleurs délais, qu’il s’agisse de la souscription à une assurance auto, ou de la demande de carte grise. Et il est vrai que lorsque vient le moment de faire immatriculer votre voiture pour la […]